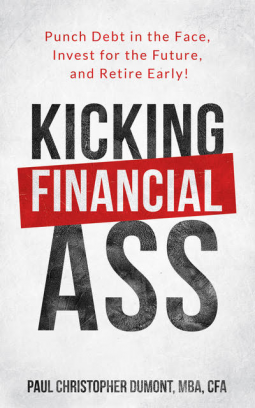

Kicking Financial Ass

Punch Debt in the Face, Invest for the Future, and Retire Early!

by Paul Christopher Dumont

This title was previously available on NetGalley and is now archived.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date 6 Aug 2019 | Archive Date 15 Dec 2019

Talking about this book? Use #Kfa #NetGalley. More hashtag tips!

Description

Why wait until 65 to retire when you can start doing what you really want when you are in the prime of your life? Whether your dream is to start your own business, volunteer, or work less, Chris Dumont provides a blueprint to early retirement and the best advice on the stock market to gain control of your finances today.

After reading this book:

• You will learn how Chris went from being over $50,000 in debt to being debt-free, owning multiples properties, and a six-figure stock portfolio within four years.

• You will be more financially secure. Chris shows you how to pay off all your debts. Once you are debt-free, you can hit your savings goals.

• You will create a budget using an easy-to use-system, with savings and expenses automatically deducted.

• You will not spend hours managing your money. Once you set things up, managing your money will be so simple that you only focus on it once a month.

You will also learn:

• Being happier with less by spending on what makes you happy.

• How much money you need to retire. (Hint: It’s not as much as you think!)

• Car advice on whether you should lease, own, or buy.

• Negotiating salaries and raises and incorporate side hustles to increase your income.

• Common investing mistakes to avoid and easy-to-understand index funds with ETFs.

• Tax-advantaged accounts you should use and why for both Americans and Canadians.

• Real estate advice and whether you should rent or own.

• And much more!

Everything he shows you is…

SET – AND – FORGET

You are covered by your emergency fund when you need it, from accidents to losing your job.

Start using the concepts he teaches in this book and retire in comfort in as few as 10 years.

Once retired, learn how to stay active and accomplish what you have always wanted.

What are you waiting for? Take control of your future today and start kicking financial ass!

CHRIS DUMONT is the founder of MoneySensei.com, a personal finance hub that helps people become debt-free.

Advance Praise

“Deftly written...a solid book of financial insights clearly aimed at millennials.”

-Kirkus Reviews

“Deftly written...a solid book of financial insights clearly aimed at millennials.”

-Kirkus Reviews

Available Editions

| EDITION | Ebook |

| ISBN | 9781999132613 |

| PRICE | $9.99 (USD) |

Links

Average rating from 66 members

Featured Reviews

Solid and comprehensive. Very well structured content to cover different aseptic budgeting, controlling your finances, planning and even brainstorming your potential side income. I think books of this kind should be a part of college or secondary school program. This is a very good guidance for new generation.

IQUOIMOH T, Educator

IQUOIMOH T, Educator

If you really want to get your finances in order this is the book to help you began your process. Must read for young people so they don’t get them selves in any financial hardship.

Kyle E, Reviewer

Kyle E, Reviewer

Easy to understand financial advice for individuals from all walks of life. This book is written in such a way that the reader is not overwhelmed with financial jargon or uncommon scenarios. Readers can take the advice given throughout and easily apply it to their financial situation. It would be beneficial for all young adults to read this book so they can gain some perspective on how to approach sound financial planning.

I really enjoyed this book. Realistic and easy to understand financial advice. Actual information that helps you understand your net worth and how to create a working budget. I especially enjoyed the list on different ways to save money which went far beyond the standard save for your future by skipping your daily coffee. While I have paid off all of my credit card debt and students loans, understanding the best way to go about it will certainly be helpful to people in that situation. The breakdowns for retirement were easy to understand and I enjoyed the real world examples! The section on investments was really well done and simplified so that anyone could get a good grasp on where to begin with their portfolio. I also found that the sections covering other types of investments, such as real estate, to be realistic and sound. I loved the section about living your life and ways to find satisfaction after retirement! It's important to understand flexible goals and be malleable during that transitional period. From one millennial to another, bravo!

I received a copy of Paul Christopher Dumont’s self-published, about-to-be-released book Kicking Financial Ass: Punch Debt in the Face, Invest for the Future, and Retire Early! via NetGalley. The bullet…It’s a highly accessible, easy to understand guide to money for anyone.

While Dumont wrote the book for his own generation of Millenials, it is actually an excellent financial resource guide for anyone. I’ve read a lot of great money books over the years including

I Will Teach You To Be Rich,

The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness, and, my favorite of all

It’s Not About the Money: A Financial Game Plan for Staying Safe, Sane, and Calm in Any Economy

They are all exceptional, but I can honestly say that Dumont’s Kicking Financial Ass: Punch Debt in the Face, Invest for the Future, and Retire Early! is the most comprehensive and the easiest to understand. If you follow his practical advice, which most of us should, you can, like him, potentially “work 9 to 5 like most … readers [and be] on track to retire in 10 years even though [he] had $50,000 of debt only four years ago.”

Dumont spends some time talking about values in the book. I actually think he could go much deeper into this topic but he does get at happiness and trying to determine what will make you happy (hint – it’s not about stuff). I actually think combining Dumont’s book and It’s Not About the Money would be an excellent combo to help you better understand your own money style and then apply that with Dumont’s tips and practical advice.

This is also the first book that I’ve read that does two things. First, it delves into the differences in Canadian accounts. While most of the book is written for Americans, the book also covers Canadian specific retirement issues. I’m just a bit of a nerd so I enjoyed reading this section. Second, Dumont takes an incredibly honest, and in my opinion, very accurate approach to real estate as an investment tool. I know far too many people who have tried to use real estate and got upside down. Dumont talks very honestly about the pros and cons of real estate.

The book also does not need to be read cover to cover. You can absolutely skip around. Kicking Financial Ass will easily become a reference book you come back to year in and year out.

While I live comfortably and with the relative security of anyone who has a good job they love and isn’t independently wealthy, I wish I’d made some of the decisions Dumont outlines in his book much earlier in life. Do yourself a favor and pre-order a copy of this book or grab a copy of this book when it releases on August 6, 2019. Grab a few copies for friends and loved ones, especially younger folks who are in the best position to take this advice and run with it.

James P, Reviewer

James P, Reviewer

To be able to live within your means, budget, and save for retirement requires a certain perspective on money, and Kicking Financial Ass starts with your attitude towards money.

Essentially it is a guide for people interest in Financial Independence, Retire Early (FIRE) and from budgeting to brainstorming your side-hustle Kicking Financial Ass, really kicks ass.

Educator 317339

Educator 317339

Every college student should read this book! It is very readable, filled with excellent suggestions on how to make smart financial decisions, and will be great to help them avoid making bad financial decisions.

This book was received as an ARC from Paul Christopher Dumont in exchange for an honest review. Opinions and thoughts expressed in this review are completely my own.

Finances is a topic that gets taken for granted because it is all about keeping up with the Jones' for some people and its all about what you own. But like $$$ once you spend it, it's gone and then you are left with mounting debt that will be troublesome in your life. Paul Christopher Dumont examines all the strategies of getting out of debt, saving money and how a low income if done right can be your greatest asset in retirement. I was blown away by this book with all the comparisons and with all the tips and tricks that got me motivated to try to help me get out of debt for good and have money be the least of my worries.

We will consider adding this title to our Business and Finance collection at the library. That is why we give this book 5 stars.

Julie A, Librarian

Julie A, Librarian

I don't think he gives any bad advice. It all makes sense with other books I've read on the subject. It's good that he includes the US and Canada. A lot of books don't mention Canada. I think this book is helpful even to Gen Xers, like me. I'm going to have another close look at my finances after reading this book.

Reviewer 210936

Reviewer 210936

Growing up my mother had me helping her use a ledger to record her expenses. I guess it was her way of teaching me budgeting. She knew back then that we wouldn’t learn to budget or balance a checkbook in school.

Unfortunately, copying her checkbook into a ledger didn’t help me either. I had no idea how to budget or why I would need to budget. After college I found myself in massive credit card debt and I had no way of paying it off. I will admit she bailed me out a few times and I’m thankful for that.

However, after she had a stroke last year, I realized I needed to man up and figure this out on my own. Adulting was a must at this point!

Since I love reading, I started looking for books to help me figure this money thing out. Doing it on my own always resulted in getting in more and more debt instead of the other way around.

There’s several great books out there that I’ve gained valuable information about money, finance, and budgeting. But when I came across Kicking Financial Ass by Paul Christopher Dumont, I was pleasantly surprised. Some of the financial info was very similar, but Dumont explains things with real life examples.

Kicking Financial Ass by Paul Christopher Dumont with a latte and a tiara #bookslattesandtiaras

Being from Canada, Dumont shares some differences between Canada and the US. Most of these differences seem to be about retirement funds and taxes. There’s also some differences in stocks and what to avoid. Otherwise, the budgeting is basically the same.

Dumont shares in this book to spend less, buy only what you need. Be aware of where your paycheck is going. Instead of buying fancy coffee, make coffee at home. Work towards investing rather than spending beyond your means. Compounding interest in an investment is better than blowing it for immediate gratification.

Kicking Financial Ass by Paul Christopher Dumont was provided complimentary in exchange for an honest review. I give this book 5 stars because it shares the best realistic examples for every day people like myself. It encourages me to get my act together and start using index funds and paying off my debts.

Readers who liked this book also liked:

Carol C. Darr

Business, Leadership, Finance, Nonfiction (Adult), Politics & Current Affairs

We Are Bookish

Business, Leadership, Finance, Nonfiction (Adult), Self-Help

Todd Irwin

Business, Leadership, Finance, Nonfiction (Adult), Professional & Technical

Patti Smith

Humor, Nonfiction (Adult), Parenting, Families, Relationships